15 years of Long Term Global Growth

15 years of Long Term Global Growth

Escape velocity

Frustrated with the constraints and assumptions that dominated the investment business, the team behind LTGG wanted it to be:

A concentrated, best ideas, global portfolio of true growth stocks, totally bottom-up, with a five-year time horizon on each stock. We would pay no attention to geographic, sector, or stock representation in the index

Launched in February 2004, Long Term Global Growth would have:

A long term approach

A global outlook

A focus on growth

A new order

From the beginning, LTGG was determined to “avoid the short-termism which plagues much of the financial industry”. The benefits of this new approach came into sharp focus in 2008 during the Financial Crisis.

LTGG Team, February 2009

We deliberately fought against the temptation to take many portfolio decisions at times of such high emotion

A new perspective

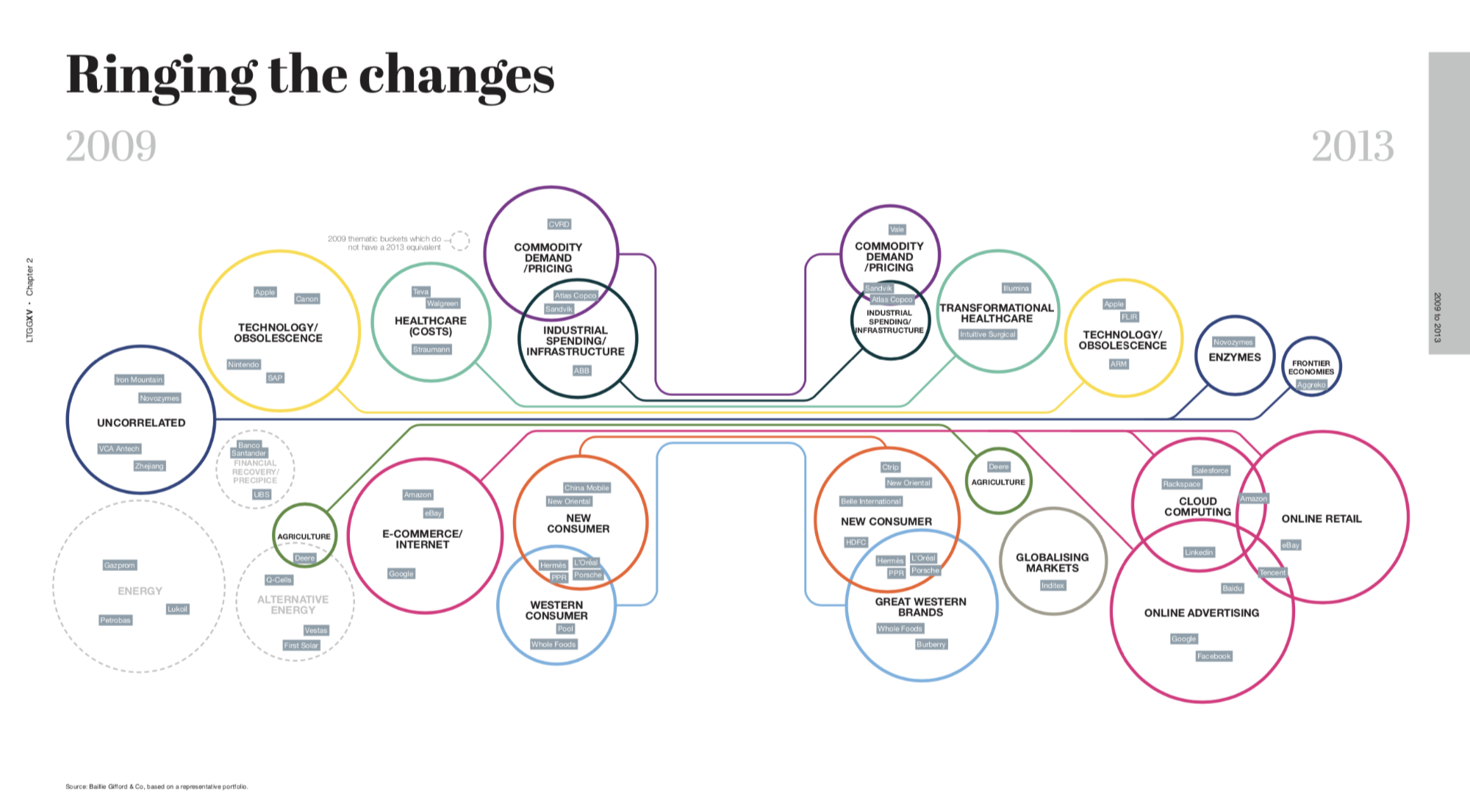

In the jittery aftermath of the global financial crisis, the challenge for LTGG was to find a new approach that ignored the index and served our long-term investment horizon. But how to ensure the portfolio was diversified enough to weather future storms? We were finding that the traditional risk approach grouping stocks by traits e.g. country and sector and analysing historical correlation were not helpful.

Evolution and revolution

The Evolution of LTGG over the first 15 years:

Going to extremes

Throughout its history, LTGG has sought out ideas and inspiration from people and places across the world.

If there is any concluding thought on the arc of LTGG’s attempted trajectory ad astra from the last 15 years, it is one that might ring familiar: Escape Velocity established, but it is still Day One

To read the full story, request your copy here